He submitted a request to another team to re-process my taxes and said I should get the refund within another eight weeks.Įveryone has a different tax situation. This time, the gentleman I spoke to said there was a system error that wouldn't fix itself. The first time I called, after the 21-day mark, they said my taxes had an error and the system should resolve the issue itself within the 12-week window after filing. It turned out my taxes hit some kind of system error. If it has been more than 12 weeks and you have not received your refund, you'll definitely want to call. I called this number: 80.Īccording to the IRS website, it can take up to 12 weeks to process some returns. That meant a phone call to an IRS agent to find out what's up. There was no real useful information on the IRS website for me, so I had to take matters into my own hands. Seeing as the IRS owed me a serious chunk of change, I didn't want to wait around to see if it would fix the problem itself. In most cases, you should get a letter in the mail if there is an issue with your taxes. You should only call if it has been more than three weeks since you e-filed or six weeks since you mailed a paper return. Note: As of March 2021, live phone assistance is "extremely limited" due to the pandemic. I waited until the 21 days had passed and called up the IRS to see what was going on.

#Federal tax refund status download

You can also find your refund status using the free IRS2Go app, but the web page worked just fine for me and I didn't have to download anything to make it work. Click the link to "Check My Refund Status" at this page on the IRS website to access the tool. Next, you'll want to point your web browser to the IRS refund status tool. What's the penalty for filing taxes late? If you have not received an expected refund, you'll need the exact amount to check your status online, so jot that down for the next step. Based on my inputs, TurboTax said I should get about $3,500 back.

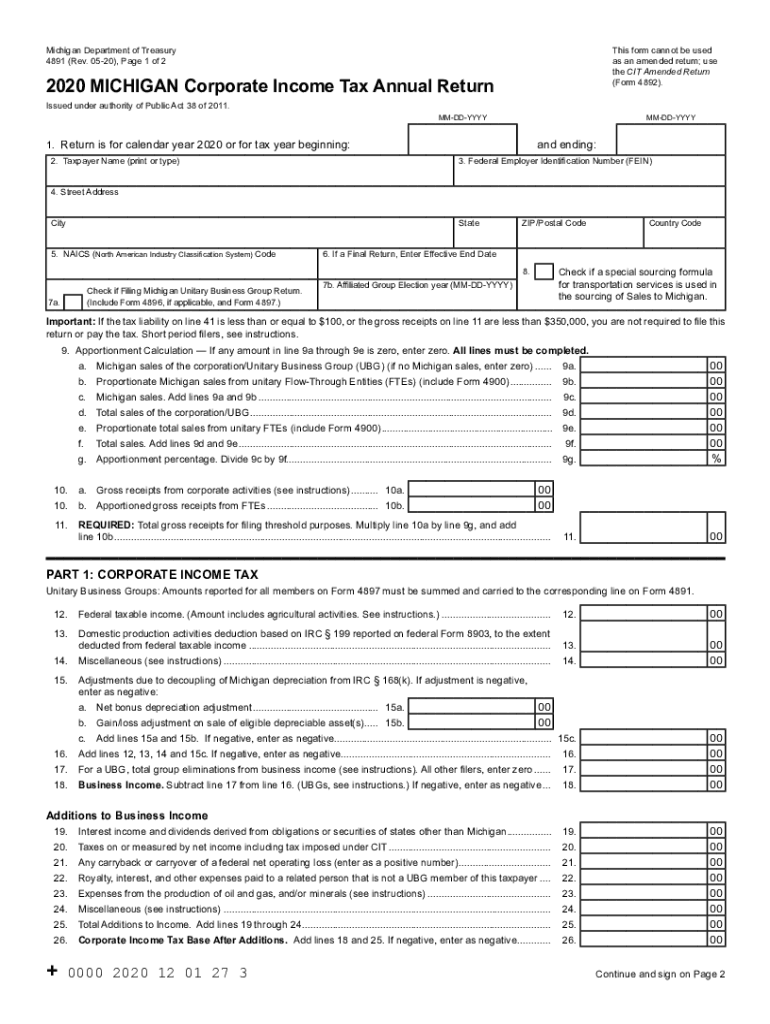

In 2018, my taxes looked a lot different. I just checked and at the ripe age of 15, I owed $17. All of my past taxes are filed away in a secure Dropbox folder, so I am always able to quickly find my 1040 forms going back to my first tax return in the year 2000. I did my personal taxes myself using TurboTax this year. The first step if you have not received your expected refund is to double check your numbers and gather your tax forms.

Gather your tax files and double-check your refund amount

#Federal tax refund status how to

How to contact the IRS if you haven't received your refund 1. If it has been longer, follow these steps to track down your refund. In most cases, taxpayers can expect to get their refund within 21 days of filing. I had to hunt down the steps to follow if your refund doesn't show up as planned. My results were much better than expected, but my refund was months late. I wasn't sure what to expect for 2018, the first filing year under the new rules of a major tax overhaul. Some years, that also comes with the good news that a tax refund is headed my way. I love adding the finishing touches to my tax return and generating pages that neatly summarize my income for a year.

It provides the same information that you would receive from one of our phone representatives.By clicking ‘Sign up’, you agree to receive marketing emails from InsiderĪs well as other partner offers and accept our Visit the Tax Department homepage at and select subscribe at the bottom of the page.ĭon’t have a computer or smart phone? Call the Tax Department’s automated refund-status line anytime at 51. You can also find out when your refund will be issued by signing up for Tax Department email alerts. To use the online application, you’ll need to enter the refund amount you claimed, your Social Security number, and which form you filed. “It’s available 24/7 and provides the same information available to our phone representatives.” “This is simply the fastest, most convenient way to determine when to expect your refund,” said New York State Commissioner of Taxation and Finance Michael Schmidt. The New York State Department of Taxation and Finance today reminded taxpayers that the quickest way to check the status of their refund is to use the Check your Refund application on its website: It’s updated daily so taxpayers can quickly view the status of their New York State tax refund anytime. Where’s Your Refund? Find Out Online Anytime NYS Tax Department offers convenient ways to check the status of refundsįor Release: Immediate, Wednesday, March 04, 2020įor press inquiries only, contact: James Gazzale, 51

0 kommentar(er)

0 kommentar(er)